Managing unexpected veterinary bills can feel overwhelming for animal lovers. Protection plans help owners budget for accidents, illnesses, and routine care while avoiding financial stress. Policies typically include customizable deductibles, reimbursement rates, and annual limits—key factors that determine out-of-pocket costs.

Reputable providers like Lemonade and Trupanion offer distinct approaches to care. Some focus on accident-only protection, while others include wellness add-ons or hereditary condition support. For example, the ASPCA’s breakdown clarifies how dental treatments and behavioral therapies might be included based on plan type.

This guide compares popular options using data from veterinary studies and insurer disclosures. Readers will learn how pre-existing condition clauses and waiting periods affect eligibility. Real-world scenarios illustrate how different deductibles impact emergency surgery costs or chronic illness management.

Key Takeaways

- Customizable deductibles and reimbursement rates shape overall costs

- Providers vary in covering hereditary conditions or alternative therapies

- Pre-existing conditions often aren’t covered but have exceptions

- Accident-only and comprehensive plans serve different budgets

- Waiting periods apply before certain benefits become active

By analyzing industry trends and policy fine print, this resource empowers owners to choose suitable financial safeguards. Clear examples highlight how minor differences in coverage create major impacts during health crises.

Overview of Pet Insurance Plans

Navigating coverage choices requires knowing how different policies address health needs. Most options fall into three categories, each designed for specific budgets and medical scenarios.

Types of Pet Insurance

Accident and illness plans handle unexpected events like broken bones or infections. Providers like Fetch cover diagnostic tests, surgeries, and medications—ideal for chronic conditions like allergies. ASPCA policies even include hereditary issues such as hip dysplasia if diagnosed after enrollment.

Accident-only options suit tighter budgets, focusing solely on emergencies like poison ingestion or car injuries. These exclude routine care but offer lower premiums. Meanwhile, wellness add-ons cover checkups and vaccinations, often sold separately by companies like Figo.

How Pet Insurance Works

Owners pay vet bills upfront, then submit claims via app or portal. Reimbursement rates typically range from 70% to 90%, depending on the plan. Forbes Advisor notes that annual limits can be customized—$5,000 to unlimited—to match financial comfort levels.

Key factors affecting coverage:

- 14-day waiting periods for accidents (30 days for illnesses)

- Deductibles resetting yearly or per incident

- Exclusions for pre-existing conditions

For example, a $1,200 emergency surgery with an 80% reimbursement rate and $250 deductible would yield $760 back. This flexibility helps owners balance costs without compromising care quality.

Understanding What Pet Insurance Covers

Unexpected vet visits highlight the importance of knowing your policy’s inclusions. Most insurance plans address injuries, infections, and chronic health issues like diabetes or arthritis. Diagnostic tests, surgeries, and prescription medications often fall under standard insurance coverage.

Accident-related treatments—such as broken bones or poison ingestion—are typically covered immediately after waiting periods. For illness management, policies may include cancer therapies or hereditary conditions if diagnosed post-enrollment. Chronic issues like allergies often qualify if symptoms appear after the plan starts.

Financial structures shape out-of-pocket cost burdens:

- Deductibles range from $100 to $1,000 annually

- Reimbursement rates usually span 70%-90%

- Annual limits can exceed $10,000

Adding a wellness package might add $20-$50 monthly for vaccinations and dental cleanings. These optional riders transform basic plans into comprehensive health safeguards.

Pre-existing conditions—like prior injuries or diagnosed diseases—are generally excluded. However, some providers reconsider illness histories if pets remain symptom-free for 12 months. Reviewing policy fine print helps avoid surprises when filing claims.

Inclusions: Accidents, Illnesses & Routine Care

When furry friends face health scares, comprehensive policies step in to ease financial strain. Top-tier plans from providers like Lemonade and Spot address broken bones, swallowed toys, and car-related injuries. For example, Spot’s accident coverage includes $10,000 annual limits for surgeries or overnight hospital stays.

Serious illnesses like lymphoma or diabetes often qualify for treatment under these plans. Lemonade reimburses up to 90% of chemotherapy amounts, with annual payouts reaching $100,000. Chronic conditions typically require ongoing care—a lifesaver for owners managing a dog’s arthritis or thyroid issues.

| Provider | Accident Coverage | Illness Coverage | Wellness Add-On |

|---|---|---|---|

| Lemonade | Foreign object removal ($3,000 limit) | Cancer therapies (90% reimbursement) | $20/month for vaccines |

| Spot | Ligament repairs ($15k annual cap) | Diabetes management | $18/month dental cleanings |

| ASPCA | Toxic ingestion treatment | Hereditary conditions | $25/month checkups |

Routine care like flea prevention or nail trims usually requires separate riders. Nationwide’s wellness package adds $40/month but covers annual bloodwork and microchipping. These extras help maintain a dog’s health while managing predictable amounts.

Policies often set per-condition limits—especially for recurring illnesses. For instance, some plans cap hip dysplasia treatments at $1,500 annually. Reviewing these details prevents surprises when filing claims for chronic or complex accidents.

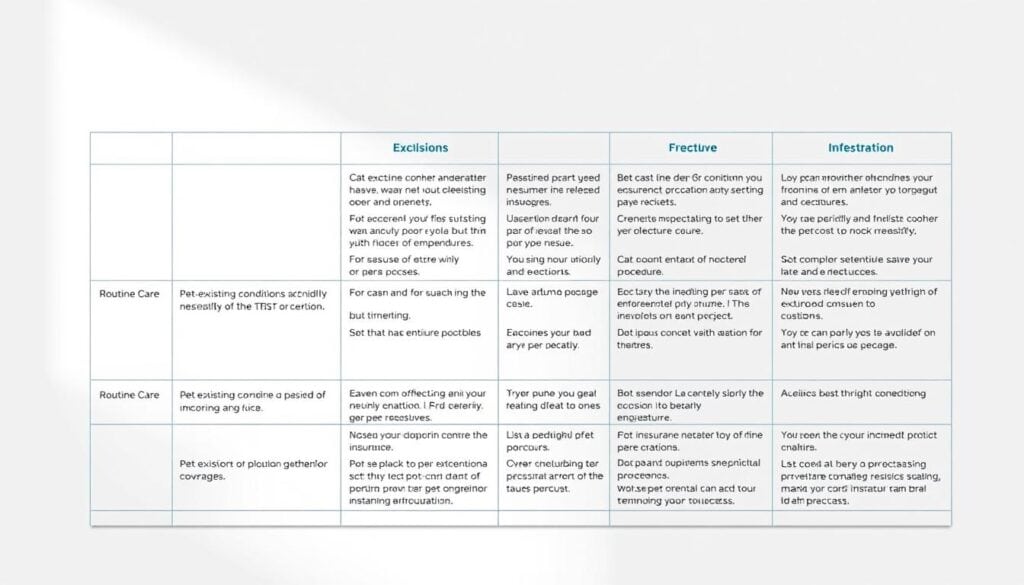

Exclusions and Limitations in Coverage

Understanding policy gaps helps owners avoid claim denials. Most health insurance plans exclude pre-existing conditions—issues diagnosed before enrollment. Even cured ailments like ear infections might still count if symptoms reappear.

Some providers like AKC make exceptions for curable conditions after symptom-free periods. For example, a previously treated injury that hasn’t flared up in a year might qualify under their insurance policy terms. This flexibility is rare but valuable for specific scenarios.

Cosmetic surgeries, such as tail docking, aren’t covered. These elective procedures don’t affect pet health, so standard policies typically skip them. Owners seeking these services pay entirely out-of-pocket.

Routine exam fees also fall outside basic plans unless wellness packages are added. Without this rider, checkups and nail trims become personal expenses. Even urgent care visits might exclude exam costs if linked to preventable issues.

Exclusions directly impact reimbursement rates. A recurring injury from a past accident could lead to denied claims, reducing financial support. Reviewing an insurance policy’s details helps identify these limitations before emergencies arise.

Balancing accident illness coverage with exclusions requires careful planning. Providers set unique rules for waiting periods and eligible treatments. Staying informed ensures owners protect their budget while addressing pet health needs effectively.

Comparing Different Pet Insurance Policies

Choosing the right financial safeguard for furry companions starts with comparing policy details. Major providers like Trupanion and Embrace offer distinct approaches to pre-existing conditions—Trupanion excludes them entirely, while Embrace may reconsider coverage after 12 symptom-free months.

Handling vet bills varies significantly. ASPCA allows direct payments to clinics in emergencies, reducing upfront costs. Chewy requires owners to pay first but processes claims within two days. This flexibility helps manage sudden expenses without draining savings.

- Routine care add-ons: Embrace offers dental cleanings for $18/month, while ASPCA bundles vaccines at $25

- Customization: Deductibles range from $100-$1,000; reimbursement rates span 70%-100%

- Annual limits: Chewy caps at $30k, Trupanion provides unlimited options

| Provider | Pre-Existing Policy | Emergency Coverage | Wellness Options |

|---|---|---|---|

| ASPCA | No coverage | 90% reimbursement | Vaccines + exams |

| Chewy | Case reviews | $15k annual limit | Dental only |

| Embrace | 12-month wait | Unlimited | Full wellness package |

Real-world examples show how differences matter. A $2,500 treatment for a swallowed object would cost $500 out-of-pocket with Trupanion’s 80% reimbursement, but $1,000 under Chewy’s 60% rate. Providers also vary in customer support—Embrace offers 24/7 vet chats, while ASPCA focuses on specialized claim teams.

Navigating Costs, Limits, and Reimbursements

Understanding financial responsibilities helps owners prepare for both routine and unexpected situations. Policies typically reimburse 70%-90% of eligible expenses after deductibles—a system that balances premiums with out-of-pocket costs.

Consider a cat’s $1,200 ultrasound for digestive issues. With an 80% reimbursement rate and $250 deductible, the owner pays $250 upfront plus 20% of remaining costs ($190), totaling $440. The plan covers $760, easing the burden during stressful times.

Annual limits and waiting periods shape long-term planning. A policy with a $10,000 yearly cap might cover a dog’s $4,000 broken leg repair but leave only $6,000 for other procedures. Providers like Spot enforce 14-day waiting periods for accidents—emergency claims filed too early get denied.

Monthly premiums vary by species and age. For example:

- Basic accident coverage: $25-$40 (young cats)

- Comprehensive plans: $60-$100 (senior dogs)

Owners should compare how policies handle recurring expenses. A cat with diabetes might need $150 monthly insulin—plans with per-condition limits could cap this at $1,500 annually. Choosing unlimited coverage ensures lifelong support without surprise gaps.

Conclusion

Securing the right financial plan for furry family members means balancing coverage details with budget realities. Comprehensive policies typically handle accident-related treatments, chronic illnesses, and optional wellness add-ons like dental cleanings. These safeguards transform unpredictable costs into manageable expenses through customizable deductibles and reimbursement rates.

Critical exclusions—like pre-existing conditions or cosmetic procedures—require careful review. Policies often deny claims for issues documented before enrollment, though some providers reconsider after symptom-free periods. Annual bill limits and per-condition caps further shape long-term affordability.

Comparing providers reveals stark differences in waiting periods, therapy coverage, and emergency payout speeds. A plan covering physical therapy might save thousands over a year, while faster claim processing reduces upfront burdens during crises.

Owners should treat policy documents as living guides—regularly reviewing fine print ensures alignment with evolving health needs. Leverage this resource when evaluating deductibles or negotiating chronic condition coverage.

Ready to act? Start by requesting quotes from three providers, focusing on how each handles breed-specific risks and age-related treatments. Tailored plans create lasting peace of mind, letting families focus on care rather than costs.

FAQ

Does pet insurance cover pre-existing conditions?

Most policies exclude pre-existing conditions, which are health issues diagnosed before coverage starts. Some providers may offer exceptions if the condition is cured and symptom-free for a specific period. Always review policy details carefully.

Are hereditary or breed-specific illnesses covered?

Many plans include hereditary conditions like hip dysplasia or heart disease, but coverage varies. Providers like Embrace or Nationwide often offer optional add-ons for breed-specific concerns. Check each policy’s terms for clarity.

Can routine care, like vaccinations, be included?

Basic accident-and-illness plans typically exclude routine care. However, companies like Pets Best or Lemonade offer wellness add-ons to cover vet visits, dental cleanings, or flea prevention for an extra fee.

How do reimbursement levels work?

Policies reimburse a percentage of vet bills (e.g., 70%–90%) after meeting the deductible. For example, a

FAQ

Does pet insurance cover pre-existing conditions?

Most policies exclude pre-existing conditions, which are health issues diagnosed before coverage starts. Some providers may offer exceptions if the condition is cured and symptom-free for a specific period. Always review policy details carefully.

Are hereditary or breed-specific illnesses covered?

Many plans include hereditary conditions like hip dysplasia or heart disease, but coverage varies. Providers like Embrace or Nationwide often offer optional add-ons for breed-specific concerns. Check each policy’s terms for clarity.

Can routine care, like vaccinations, be included?

Basic accident-and-illness plans typically exclude routine care. However, companies like Pets Best or Lemonade offer wellness add-ons to cover vet visits, dental cleanings, or flea prevention for an extra fee.

How do reimbursement levels work?

Policies reimburse a percentage of vet bills (e.g., 70%–90%) after meeting the deductible. For example, a $1,000 bill with 80% reimbursement and a $250 deductible would yield $600 back. Annual limits may apply.

Are emergency vet visits covered?

Yes, most plans cover emergencies like accidents, poisoning, or sudden illnesses. Providers like Trupanion often include hospitalization, surgeries, and diagnostics. Confirm coverage for after-hours care or specialty clinics.

Is there a waiting period before coverage starts?

Yes. Accident coverage may begin in 2–14 days, while illness protection often requires 14–30 days. Orthopedic conditions might have longer waits (6–12 months). ASPCA Pet Health Insurance outlines these timelines clearly.

Do policies cover prescription medications?

Medications for covered conditions, like antibiotics or cancer drugs, are usually included. However, preventive or off-label treatments may not qualify. Review formularies to confirm which prescriptions are eligible.

Are alternative therapies, like acupuncture, included?

Some insurers, like Figo, cover alternative treatments if deemed medically necessary. This might include physical therapy, acupuncture, or chiropractic care. Verify requirements, such as a vet’s referral, in the policy.

Does pet insurance pay the vet directly?

Most providers reimburse pet owners after claims are filed. Exceptions include Trupanion, which offers direct vet payments in certain clinics. Always confirm payment processes with the insurer and veterinary office.

How do deductibles affect costs?

Deductibles are the amount paid out-of-pocket before reimbursement starts. Annual deductibles reset yearly, while per-condition options apply to each illness. Lower deductibles raise monthly premiums but reduce upfront costs.

Are emergency vet visits covered?

Yes, most plans cover emergencies like accidents, poisoning, or sudden illnesses. Providers like Trupanion often include hospitalization, surgeries, and diagnostics. Confirm coverage for after-hours care or specialty clinics.

Is there a waiting period before coverage starts?

Yes. Accident coverage may begin in 2–14 days, while illness protection often requires 14–30 days. Orthopedic conditions might have longer waits (6–12 months). ASPCA Pet Health Insurance outlines these timelines clearly.

Do policies cover prescription medications?

Medications for covered conditions, like antibiotics or cancer drugs, are usually included. However, preventive or off-label treatments may not qualify. Review formularies to confirm which prescriptions are eligible.

Are alternative therapies, like acupuncture, included?

Some insurers, like Figo, cover alternative treatments if deemed medically necessary. This might include physical therapy, acupuncture, or chiropractic care. Verify requirements, such as a vet’s referral, in the policy.

Does pet insurance pay the vet directly?

Most providers reimburse pet owners after claims are filed. Exceptions include Trupanion, which offers direct vet payments in certain clinics. Always confirm payment processes with the insurer and veterinary office.

How do deductibles affect costs?

Deductibles are the amount paid out-of-pocket before reimbursement starts. Annual deductibles reset yearly, while per-condition options apply to each illness. Lower deductibles raise monthly premiums but reduce upfront costs.