Navigating healthcare billing can feel overwhelming, but it doesn’t have to be. This guide is designed to simplify the process for medical providers and professionals in the United States. Whether you’re new to submitting requests or want to refine your approach, this walkthrough covers everything from documentation to tracking payments.

A claim is a formal request sent to insurance companies to receive payment for services. Once approved, reimbursement refers to the funds returned to the provider. Accuracy matters here—proper medical coding and clear billing details help avoid delays. Submitting claims on time ensures payments arrive within the same month, keeping cash flow steady.

This guide breaks down each step, starting with gathering patient information and ending with post-payment reviews. You’ll learn why double-checking codes and deadlines is non-negotiable. Plus, actionable tips help streamline workflows so providers focus less on paperwork and more on care.

Key Takeaways

- Claims are formal payment requests, while reimbursements are the funds returned by insurers.

- Accurate coding and documentation reduce delays and denials.

- Timely submissions help secure payments within the same billing cycle.

- Tracking each payment ensures transparency and financial stability.

- Post-payment audits help identify errors and improve future processes.

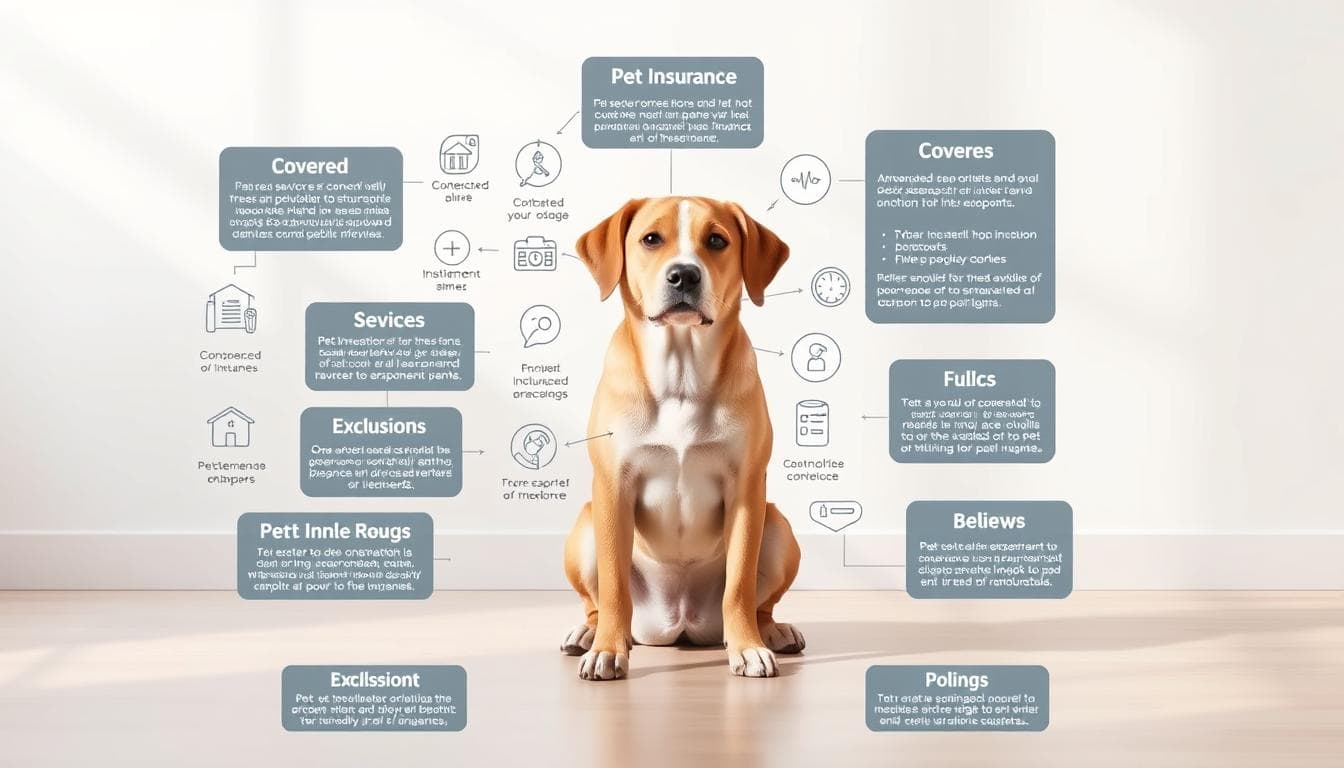

Understanding Claims & Reimbursements

Ever wondered how healthcare providers get paid for their services? It starts with two foundational concepts: submitting formal requests and receiving funds for care delivered. Let’s break down how this system operates.

Defining the Basics

A claim is a detailed request sent to insurers to receive payment for treatments. Once approved, the reimbursement is the money returned to the provider. These transactions keep clinics running smoothly.

How It All Comes Together

Insurers use models like fee-for-service (paying per treatment) or bundled payments (one payment for multiple services). For example, a broken arm might involve X-rays, casting, and follow-ups—each billed separately or as a package.

Here’s the typical flow:

- Enter patient information into electronic health records.

- Assign medical codes that match services provided.

- Submit claims through secure portals.

- Wait for insurer review (usually 2-4 weeks).

Mistakes in coding or missing details can push payments into the next month. One clinic reduced denials by 40% after training staff on code accuracy. As one billing specialist notes: “Clean claims mean faster resolutions.”

Tracking each step helps spot delays early. Providers who master this process often see steadier cash flow and fewer headaches.

Preparing Your Claim: Documentation and Coding

A well-prepared claim starts long before submission. Proper organization of patient details and medical codes forms the backbone of successful transactions. Let’s explore how providers build error-free submissions from the ground up.

Gathering Essential Information

Thorough documentation begins with verifying patient demographics, insurance details, and treatment history. Clinicians should record symptoms, diagnoses, and procedures in electronic health records (EHR) during each visit. Missing data like referral authorizations or prior approvals often causes delays.

| Required Information | Common Errors |

|---|---|

| Insurance policy number | Expired coverage |

| Procedure dates | Illegible service notes |

| Clinical rationale | Missing signatures |

Assigning Accurate Medical Codes

Medical coding translates treatments into standardized ICD-10 (diagnoses) and CPT (procedures) codes. A mismatched code can slash reimbursement amounts by 15-30% or trigger denials. For example, coding a complex fracture as a simple break might undercut payment.

| Code Type | Purpose | Example |

|---|---|---|

| ICD-10 | Diagnoses | S72.001A (hip fracture) |

| CPT | Procedures | 99213 (office visit) |

Double-checking codes against clinical notes prevents disputes. Many providers use coding software to flag inconsistencies. This attention to detail helps secure full payment within the same month while simplifying future audits.

Submitting Your Claim and Handling Denials

Mastering electronic submissions helps providers avoid common pitfalls and delays. Modern systems cut approval times by 50% compared to paper methods. Let’s explore how to submit requests efficiently and resolve issues when insurers push back.

Electronic Submission Best Practices

Clearinghouses act as middlemen, reformatting claims to meet insurer requirements. They flag errors like mismatched codes before submissions go through. One clinic reduced denials by 30% after adopting this step.

Key strategies include:

- Running automated checks for missing data

- Confirming patient eligibility in real-time

- Sending batches early in the week to avoid weekend delays

Interpreting Payer Responses

Remittance advice codes explain why insurers adjust or deny payments. Codes like “CO-22” mean missing clinical notes, while “PR-1” signals contractual discounts. Addressing these within 5 business days keeps corrections on track.

When facing denials:

- Compare the rejection reason with original documentation

- Update codes or add supporting files

- Resubmit through the same portal to maintain timelines

A pediatric group reclaimed $12,000 in 3 months by training staff to decode these alerts. “Quick fixes turn losses into recoveries,” their billing manager notes. Staying proactive ensures most issues resolve within the same billing cycle.

Managing Payment Schedules and Post-Payment Audits

Staying on top of payments requires a mix of organization and proactive follow-ups. Providers who master this balance reduce financial hiccups and maintain steady cash flow. Let’s explore how to track timelines effectively and tackle audits confidently.

![]()

Tracking Reimbursement Timelines

Most insurers process payments within 25-30 days after claim approval. Use digital trackers to log submission dates and flag delays. Tools like calendar alerts or billing software send reminders when funds are overdue.

Here’s a simple breakdown:

| Phase | Timeline | Action |

|---|---|---|

| Submission | Day 1 | Confirm receipt via portal |

| Review | Days 3-10 | Check for adjudication updates |

| Payment | Days 25-30 | Follow up if pending |

One clinic improved on-time payments by 60% using color-coded dashboards. “Visibility stops guesswork,” their finance lead notes.

Addressing Common Audit Issues

Post-payment audits often target coding errors or missing documentation. Insurers might request visit notes or authorization forms months later. Keep records organized in labeled digital folders for quick access.

Top audit triggers include:

- Mismatched diagnosis and procedure codes

- Missing patient signatures on forms

- Services billed above policy limits

Respond to inquiries within 48 hours. Attach clear scans of requested files and reference original submission dates. A dermatology group cut audit resolution time by half using this approach. Staying prepared turns audits into minor speed bumps rather than roadblocks.

Enhancing the Claims Process for a Smooth Experience

Streamlining the claims process requires both smart tools and strategic partnerships. Providers who adopt modern solutions often see faster approvals and fewer disputes, creating a win-win for clinics and patients alike.

Leveraging Technology for Efficiency

Advanced billing software cuts errors by auto-checking codes and patient eligibility. For example, a Texas clinic reduced denials by 55% after switching to AI-powered tools that flag mismatched ICD-10 codes before submission.

Data analytics dashboards track trends like frequent denial reasons or slow-paying insurers. One orthopedic group used these insights to shorten their average payment window from 34 to 21 days. “Real-time metrics let us fix bottlenecks on the fly,” their administrator explains.

Negotiating with Insurance Providers

Regular contract reviews help clinics secure better rates. A Midwest hospital boosted reimbursement by 18% after presenting utilization data during payer negotiations. Key strategies include:

- Benchmarking service costs against regional averages

- Highlighting patient volume to justify rate increases

- Requesting quarterly check-ins to discuss payment terms

Combining tech upgrades with collaborative talks creates a reliable process. Providers who master both areas often report steadier cash flow and stronger insurer relationships.

Conclusion

Mastering the healthcare billing cycle transforms challenges into opportunities. By focusing on claim accuracy and organized workflows, providers can secure timely reimbursement while reducing administrative stress.

This guide outlined essential steps: precise documentation, error-free coding, and proactive denial management. Each action directly impacts cash flow. For example, using technology to flag coding mismatches helps clinics recover money owed faster.

Even complex audits become manageable with digital tracking systems and labeled records. A Midwest hospital improved audit responses by 50% using these methods. As one administrator noted: “Preparation turns chaos into control.”

Adopting these strategies creates predictable revenue streams. Start refining your approach today—your practice’s financial health depends on it. Clean claims and full reimbursement await those who implement these proven techniques.

FAQ

What steps are involved in filing a claim?

The process starts with gathering required documents like invoices or receipts. Next, accurate medical codes are assigned, followed by submitting the claim electronically. Providers then wait for approval and track payment timelines.

How long does reimbursement typically take?

Most payments arrive within 30–60 days after approval, depending on the payer. Delays can occur if documentation is incomplete or codes are mismatched. Tracking tools help monitor timelines.

What should providers do if a claim is denied?

Review the payer’s explanation for denials, correct errors like missing codes, and resubmit promptly. Appealing with additional documentation often resolves disputes.

How can technology improve the claims process?

Software like Epic or Cerner automates coding, reduces errors, and speeds up submissions. Electronic health records (EHRs) also streamline audits and payment tracking.

What are common audit issues providers face?

Frequent problems include mismatched diagnosis codes, missing signatures, or insufficient proof of service. Keeping organized records and using audit-management tools minimizes risks.

Can providers negotiate reimbursement rates with insurers?

Yes. Many insurers like UnitedHealthcare or Aetna allow rate discussions. Presenting data on service costs and regional benchmarks strengthens negotiation positions.